Private Credit

At MBA HOLDING LLC, our goal is to generate consistent high yields by deploying capital into a diversified portfolio of real estate debt investments, with a specific focus on residential real estate in the Sunbelt region.

The current market conditions, including the aftermath of a 15-year expansionary monetary policy and the recent rise in interest rates, present a unique investment opportunity in real estate credit. We aim to capitalize on this market dislocation by identifying and investing in credit opportunities with attractive risk-adjusted returns.

Our Investment Strategy Drivers

Residential Lending Program

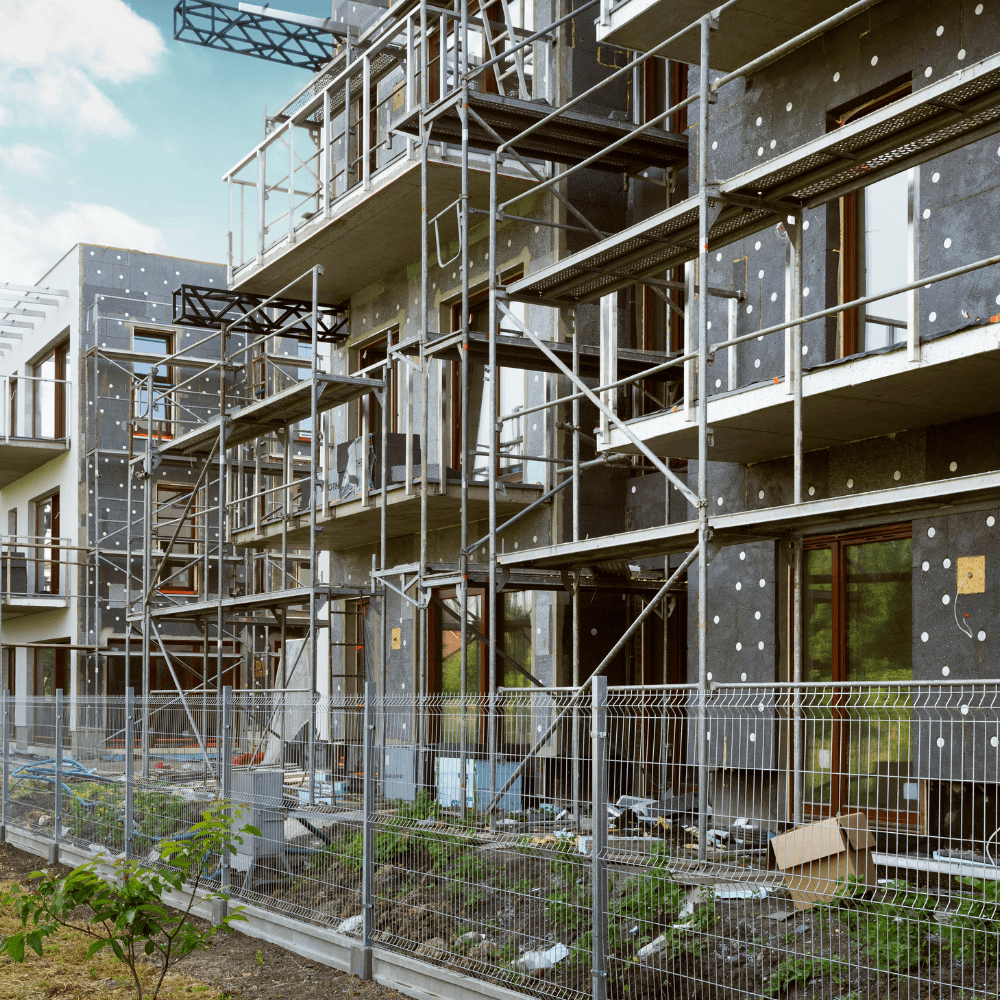

We participate in a structured lending program that offers flexible and competitive senior loans, mezzanine debt, and senior preferred equity for residential real estate projects, particularly in multifamily and build-for-rent (BFR) single-family communities. This program seeks to mitigate risk by lending senior to the borrower’s equity, typically investing at 65% to 80% of loan-to-value (LTV) ratios

Homebuilder Financing

Our participation in homebuilder financing focuses on lending to some of the largest single-family homebuilders in the country. Demographic shifts and lifestyle trends, combined with a shortage of affordable housing, drive strong demand for housing. By partnering with leading homebuilders across the US, we invest in attractive locations with best-in-class partners.

Opportunistic Lending

In select scenarios, we take advantage of market dislocations resulting from changing economic conditions to deploy capital opportunistically across various asset classes and markets where we perceive attractive risk-adjusted returns.